How Much House Can I Afford

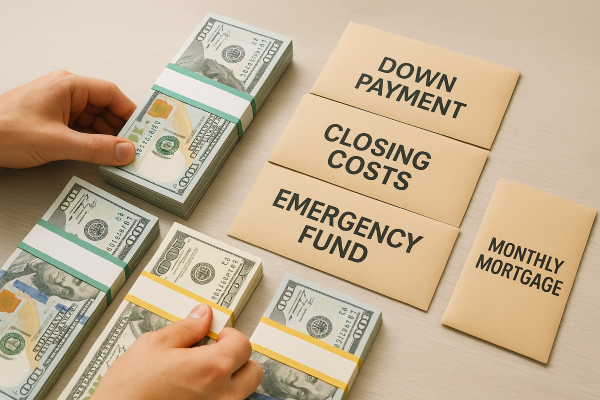

Saving for a house? The envelopes don’t lie — but they can show you exactly how to change your future.

Saving for a house? The envelopes don’t lie — but they can show you exactly how to change your future.I want to buy a house! I only have a few bills, but don't have a lot of money saved. How can I figure out how much house I can afford?

Assess Your Financial Picture

Before you begin comparing neighborhoods or scrolling through listings, your first step is understanding exactly where you stand financially. This gives you a clear foundation and prevents you from guessing at what you can realistically afford.

Begin by gathering the three essentials:

- Income: Your total monthly earnings before taxes.

- Debts: Credit cards, auto loans, student loans, personal loans, or any recurring monthly obligations.

- Living Expenses: Utilities, groceries, insurance, childcare, transportation, and other lifestyle costs.

This financial snapshot makes it easier to understand how much room you truly have for a mortgage payment. Some buyers discover they have more buying power than expected, while others gain clarity on what adjustments will make homeownership more comfortable.

Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is one of the main ways lenders determine how much house you can afford. It compares the amount of debt you pay each month to your gross monthly income, giving both you and your lender a picture of your financial capacity.

The formula is simple:

- DTI = Total Monthly Debt Payments ÷ Gross Monthly Income

Most lenders prefer a DTI of 43% or lower once your new mortgage payment is included. Staying around or below this range keeps your payment in a safer, more manageable zone.

Here’s an example to make the math clearer:

- Gross monthly income: $7,000

- Maximum recommended total debt (43%): $3,010

- If current debts equal $700, then about $2,310 remains available for a potential mortgage payment.

This backward budgeting helps you shop within a realistic range before you even speak to a lender.

Down Payment Options

Your down payment plays a big role in determining how much house you can afford. It affects your loan amount, monthly payment, interest costs, and whether you'll owe mortgage insurance. The good news is that today’s buyers have far more flexibility than the old “20% down or nothing” rule suggests.

Here are common down payment paths to consider:

- 20% Down: The classic benchmark. You eliminate PMI, lower your interest costs, and start with instant equity.

- 10% Down: A strong option for buyers who have some savings. PMI is lower than with smaller down payments, and monthly payments stay more manageable.

- FHA Loans (3.5% Down): Ideal for first-time buyers or those rebuilding credit. FHA loans require a small down payment and offer flexible approval standards.

- VA Loans (0% Down): Available to eligible veterans and active-duty service members. These loans require no down payment and no PMI, making them one of the most affordable homeownership paths.

There is no “best” down payment amount — only what aligns with your comfort level, financial goals, and timeline. Your focus should be on finding the balance between upfront savings and a sustainable monthly payment.

Ownership Costs

Determining how much house you can afford goes beyond the mortgage payment. Homeownership brings several additional costs—some predictable, some unexpected—that should be factored into your monthly and annual budget. Planning for these early keeps your financial picture steady and avoids unwelcome surprises.

Key costs to evaluate include:

- Closing Costs: Typically 2–5% of the home’s purchase price, covering lender fees, title work, escrow, and more.

- Property Taxes: Varies by location but paid annually or rolled into your monthly mortgage payment.

- Homeowner’s Insurance: Required by lenders and based on coverage amounts, property type, and location.

- Mortgage Insurance (if applicable): PMI or MIP may apply if your down payment is below certain thresholds.

- Maintenance & Repairs: A common rule of thumb is to set aside 1–2% of the home’s value annually for upkeep.

- Utilities & Upgrades: Appliances, landscaping, paint, furnishings, or higher utility usage in larger homes.

- HOA or Condo Fees: Applies to communities with shared amenities or maintenance services.

When you calculate these costs alongside your mortgage payment, you’ll gain a true understanding of what fits comfortably within your long-term budget.

Get Pre-Approved

Once you have a clear picture of your finances, the next step is getting pre-approved for a mortgage. This isn’t just a formality—it's a crucial part of understanding exactly how much house you can afford and proving to sellers that you’re a serious buyer.

During pre-approval, a lender reviews your financial documents, verifies your income, and evaluates your credit strength. In return, you receive a written estimate of the loan amount you qualify for, along with the interest rate and loan type options.

Pre-approval gives you several key advantages:

- A defined price range: You’ll know the exact budget you should be shopping within.

- Greater negotiating power: Sellers view pre-approved buyers as more reliable and ready to move.

- Faster closing process: Much of the financial review is already completed.

This step transforms your home search from hopeful browsing to confident, targeted decision-making.

Long-Term Goals

Your home purchase should support your life—not strain it. That’s why it’s important to consider how a new mortgage fits into your long-term financial plans. A house you can afford today should still feel comfortable years from now as your needs, priorities, and income evolve.

As you decide how much house you can afford, think through these long-term questions:

- Will your income likely grow, stay stable, or fluctuate? Career plans and job security can help shape the ideal mortgage range.

- Are you planning to increase retirement savings? Your mortgage shouldn’t compete with long-term wealth-building goals.

- Do you anticipate future lifestyle changes? Family growth, downsizing, caregiving, or travel goals all impact affordability.

- Do you want to pay down debt faster? A comfortable mortgage keeps room in your monthly budget for debt reduction.

- Are you building an emergency fund? A solid safety cushion makes homeownership less stressful and far more stable.

Balancing these long-term goals with your mortgage payment ensures your home remains a source of stability—not financial pressure.

Related Home Buying Affordability Resources

Explore more guides that help you make confident, well-informed home-buying decisions:

- Choosing the Right Neighborhood — Learn how to compare amenities, schools, lifestyle fit, and long-term value.

- What to Know Before Buying a House — A practical guide covering inspections, budgeting, negotiation, and preparation.

- Real Estate Articles for Buyers — A full library of buyer-focused topics designed to help you move forward with clarity.

Home > Real Estate Questions > How Much House Can I Afford