Foreclosures and What You Need To Know

Facing foreclosure? Or just afraid you might be headed in that direction? You’re not alone—and you’re not powerless. Whether you’ve already missed a mortgage payment or just see the writing on the wall, now is the time to prepare, not panic. This guide is here to help you understand the process, take early action, and keep your financial future from slipping away.

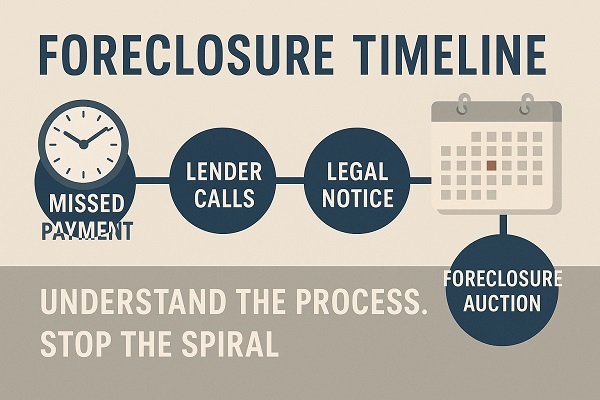

Step 1: Understand What’s Happening—Foreclosure Is a Process, Not a Surprise

Foreclosure rarely happens overnight. In fact, if you're heading toward it, your lender is required to notify you—often multiple times—through letters, emails, and phone calls. It may feel overwhelming, but those messages are more than warnings. They're signals that it's time to act. Fast.

The takeaway: Don't ignore the mail or screen the calls. The sooner you respond, the more options you'll have.

Step 2: Know This—Your Lender Doesn’t Want to Foreclose

Here’s what many homeowners don’t realize: banks lose money on foreclosures. They don’t want your house. They want your loan back on track.

That’s why it’s crucial to reach out to your lender early—and ask to speak with a decision-maker like the branch manager or head loan officer. This isn’t the time for online portals or generic customer service calls. An honest conversation can lead to real solutions.

Tip: Be honest about your situation. Whether it’s temporary job loss, medical leave, or a reduction in hours, banks are often more flexible than people think when there’s a path to recovery.

Step 3: Don’t Assume Foreclosure Means Game Over

Foreclosure doesn't mean you're being thrown out tomorrow. In fact, the timeline and procedures vary widely depending on where you live.

There are two common types of foreclosure:

-

Judicial Foreclosure: Requires the lender to sue you in court. You'll have time to respond and may get one last chance to pay what you owe.

- Non-Judicial Foreclosure: In some states, if your mortgage agreement includes a "power of sale" clause, your lender can begin foreclosure without court involvement.

Not every state allows both, which is why state law matters. A local attorney, housing counselor, or HUD-approved advisor familiar with your area can guide you more effectively than a general resource ever could.

Step 4: Keep a Paper Trail and Ask the Right Questions

Document everything. If you speak to someone at the bank, write down their name, department, and what was said. Save every letter and email. This gives you leverage—and clarity—if things move forward.

Here are a few questions to ask your lender:

- Can I apply for a mortgage forbearance or loan modification?

- Are partial payments an option while I get back on track?

- What's the timeline if foreclosure proceeds in my state?

Step 5: Have a Backup Plan—Even If You Don’t Need It Yet

The hardest part of foreclosure is accepting that you may have to leave your home. That doesn't mean you should wait until an eviction notice shows up.

Start thinking through:

- Where would you go if you had to move?

- Can you stay with your family temporarily?

- Would a rental or apartment be more affordable?

- Do you have money for a security deposit?

Planning early gives you time to make wise decisions—not panicked ones.

Step 6: Lean on Free Resources—They Exist for a Reason

If you're feeling emotionally drained or unsure where to turn, don't carry it alone. There are free or low-cost support options that can help you navigate this storm.

- HUD-Approved Housing Counselors: Find one here

- Local Legal Aid Clinics (especially if your foreclosure is judicial)

- Credit Counseling Services to help you budget and plan

Don't wait until the court papers arrive. Reach out now, even if you're still current on your loan but feeling the squeeze.

Bottom Line: Foreclosure Doesn’t Have to Define You

The word "foreclosure" strikes fear into homeowners—but with the correct information and early action, you can steer the outcome. It might mean modifying your loan. It might mean downsizing. It might mean starting over. But it absolutely does not have to mean failure.

Know what to expect. Ask for help. Make a plan.

And most importantly—don't panic. Get prepared.

Related pages you might also like

Making Big Money Investing In Foreclosures Without Cash or Credit 2nd edition

Learn how investors buy foreclosures creatively—without cash or perfect credit. See the other side of the deal and how to spot opportunity, even in crisis.

How To Find Foreclosures

Need to relocate? This guide breaks down where and how to search foreclosure listings (free and paid) so you can plan your next move strategically.

Fix and Flip Field Guide

If you're ready to start over or explore a new income stream, this guide shows how to profitably flip homes—even if you're on a budget.

Home > Real Estate Articles >> Foreclosures >> Foreclosures and What You Need To Know