Best Credit Card Deals

Best Credit Card Deals! Chances are you have at least a few credit cards, but did you get the best deals? If you've been late paying bills, you don't. But that's okay, as there are ways to get better rates. Here's how to dig out of a hole if you have some bad ones.

Start Paying On Time, But Not Your Whole Bill

The most desirable customers for credit card companies are those who make monthly payments on time (showing that they're dependable). But they don't pay off the whole balance (so the companies can still profit from the interest).

Suppose you maintain a consistent pattern of running a relatively small balance each month. In that case, the companies are satisfied and are inclined to offer you better interest rates.

Profit From Your Ability to Choose

Many credit card companies are available, making the industry extremely competitive. Sometimes they are as eager to keep your business as you are to have an account with them. Exploit that sentiment to get the best credit card deals possible.

So, when you find better rates, all bets are off, as you'll lose money by not taking advantage of deals that offer things like "0 apr credit and 0 balance transfers."

Ask For Reduced Rates To Get The Best Credit Card Deal

I've gotten reduced interest rates on existing accounts by simply calling my credit card companies and asking for them. Some did, and others didn't, but you'll never know until you ask.

I've found that they're more likely to lower your rates when they think you're about to close your accounts with them and transfer your balance to another company. You can do the same to get the Best Credit Card Deals, and a good approach is to have a conversation something like this:

Them: Hello, how may I help you

You: Oh, hi. I was calling to ask if there's anything that you need to do to transfer my balance to a new card I'm getting.

Them: What card is that?

You: Oh, I got the offer in the mail this morning. [Tell all about the great interest rate and everything].

Them: And you've accepted that offer?

You: I'm just about to, yes.

Them: Well, hang on, we might be able to offer you a better rate on the card you've got."

The key to getting the best credit card deals is to get the company to think you're really about to leave due to the advertising, and they will try to keep you as a customer.

You don't need to talk about your status as a good customer, as they already have access to your records and understand your value.

As you have nothing to lose, only things to gain, drive a hard bargain and be prepared to walk away.

If you turn down their so-called 'best offer,' hang up, as there's a good chance they'll call to offer you a better one!

An often amusing tactic is to phone your current company, get an offer from them, then phone other companies to see if you can get one to beat it. Once better, call your company back and let them know.

These tactics are fundamental in many business situations, which is why they work so well. As these companies prefer to have your business (as opposed to none), they will often compromise to keep you as a customer.

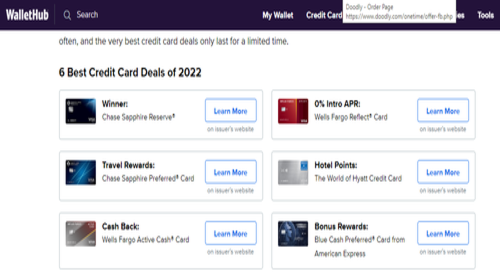

Six Best Credit Card Deals Selected from 1,500+ credit cards for December 2022

Related Pages you might like

Cash Advances and Credit Card Checks: Warning! Using a credit card check or accepting cash advances implies that you truly need the money. It signals to the credit card companies that you're someone who shouldn't be given a high credit limit and won't be able to clear your current debt anytime soon. >>>

Consolidation Loans: Consolidation loans can combine many of your debts into single loan payments, simplifying the number of payments you have to make and when to make them. Offers can also include lower interest rates than what you're currently paying, more time to repay the loan, and the like. >>>

Credit Card Debt: You may not realize it, but using a credit card makes your money worth less than it would otherwise be, which is why credit cards seem so much harder to pay back. If you borrow $100 compounded annually @t 15% interest and pay it off in one payment in five years, you will owe $201.14! That's double what you borrowed. How else are you squandering money? >>>

Home Page > Real Estate Website Content >> Credit Card-Marketing-Reports >> Best Credit Card Deals

Tags: Real Estate Articles >> Real Estate Marketing Reports

Best Credit Card Deal Image by Image by blackzheep at FreeDigitalPhotos.net

Request for Reduced Rate Image by adamr at FreeDigitalPhotos.netTime for Goodbyes Image by Stuart Miles at FreeDigitalPhotos.net